life insurance face amount and death benefit

So if you buy a policy with a. April 30 2021.

The Risk Of Surviving To Policy Maturity What Trustees Need To Know Ric Omaha

This often goes by the name death benefit option A or 1.

. Ad Youre eligible to apply for exclusive term life insurance from New York Life. In most situations the concept of the Face Amount can often commonly be replaced by Death Benefit. Permanent life insurances face amount is the death benefit paid to your beneficiaries and the cash value is a separate amount that you can use while youre still alive.

The accumulated death benefit will be a combination of the face amount and the cash savings of the policy. Toggle menu toggle menu path dM526178 313114L447476 606733L741095 685435L819797 391816L526178 313114Z fillF9C32D. The average life insurance rate for a 20-year 500000 term life policy for a 30-year-old woman is 190 a year according to Quotacy a brokerage firm.

Life Auto Home Health Business Renter Disability Commercial Auto Long Term Care Annuity. The face amount of a life insurance policy tells you how much it pays out to your loved ones or beneficiaries when you die. Life Insurance Face Amount May 2022.

The Level Death Benefit Option maintains a constant death benefit amount throughout the life of the insurance policy regardless of accumulated values andor premiums paid by the policy owner. The death benefit is used to provide income for those that rely on the insured. When you discuss how much life insurance you need youre considering which face value is right for you.

Increasing Death Benefit- It is another kind of exciting option in any kind of policy. FREE Quotes No Obligations. The death benefit of your life insurance policy is just a technical term for face amount.

At the beginning of the policy the face value and the death benefit are the same. The face amount is the initial amount of money stated on the life insurance application when you first buy the policy and is intended to be paid as a death benefit to your heirs. For the same client the average annual.

The face amount of a policy is the amount you request when you apply for life insurance. Life Insurance Death Benefit Jun 2022. If you decide for example you want to leave your loved ones with 200000 you apply for life insurance with a 200000 face value.

A structure of an increasing death benefit UL and cost will depend on the assumption of the target case value. The death benefit of a life insurance policy represents the face amount that will be paid out on a tax-free basis to the policy beneficiary when the insured person dies. Life insurance death benefits financially protect your beneficiaries from the loss of your income and expenses.

Ad Plan Your Financial Future With Jackson. How much and a what age. For example if you buy a 100000 life insurance policy the face amount of that policy is 100000.

Its the amount of death benefit purchased which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies. The face amount is the initial death benefit on a life insurance policy. However as time.

One rule of thumb used to determine the amount of insurance needed is to multiply your annual salary by 10. The face amount indicates the initial coverage as indicated on the policy. For example if you earn 50000 a year a good estimate of how much insurance you may need would be a 500000 policy.

Typical cash value targets will be 1 or to endow to be worth the initial face amount in cash at either age 100 or age 120. The death benefit amount is determined when you first buy the policy and in many instances is equivalent to the face amount or face value of insurance. Call a licensed expert.

Whole life the high quality ones age guaranteed to endow at age 100. It is the amount of money that will be given to the beneficiary at the time of the insureds death. Learn How Jackson Can Help You Get Started On Your Journey To Financial Freedom.

The face value is typically how much your life insurance beneficiaries will receive if you die while your policy is in force. The Face Amount of Life Insurance. The death benefit is the actual amount the carrier pays your beneficiaries and you can tack on additional benefits with riders.

The face amount or face value of a life insurance policy is the amount of money an insurer will pay out to beneficiaries if the policyholder passes away. When a life insurance policy is identified by a dollar amount this amount is the face value. Life Auto Home Health Business Renter Disability Commercial Auto Long Term Care Annuity.

In some forms of life insurance the. The first death benefit option is a level death benefit. Insurer will absorb the cash value of your whole life insurance policy after you die and your beneficiary will get the death benefit.

How Life Insurance Face Amount and Death Benefits are Calculated. But as the cash value of the policy changes over time it can alter the total death benefit either above or below the face. If you borrow money from the cash value of your whole life insurance then.

The face value of life insurance is equivalent to the death benefit you select when purchasing a policy. The death benefit is the actual amount the carrier pays your beneficiaries and you can tack on additional benefits with riders. Help protect your loved ones with valuable term coverage up to 100000.

Your policys death benefit is the same as your policys face amount and vice versa. You can borrow or withdraw money from your life insurance policy. Begin Your Journey To Financial Freedom.

All life insurance policies have a face value. A 500000 policy therefore has a face value of 500000. Level Death Benefit Beneficiaries will only get the face amount as per the initial insurance contract.

Life insurance death benefit is the sum of money an insurer pays to beneficiaries upon your death provided the coverage was in force at the time of the event. The face amount is the initial amount of money stated on the life insurance application when you first buy the policy and is intended to be paid as a death benefit to your heirs. You can also use the money to pay for your premiums.

The face amount death benefit remains level and cash value continues to earn interest and mature at age 100 single premium the entire premium is paid in a lump sum at the time of purchase and creates immediate cash value The face amount is the initial amount of money stated on the life insurance application when you first buy the policy and. The death benefit is paid to the stated beneficiaries of the contract which are determined by the owner before the insured person is deceased. Generally life insurance with a higher face value will cost more in premiums.

Normally the face amount is a round number like 50000 or 100000. Home Answers what is the difference between the face value and death benefit in whole life policy Asked July 10 2015. The death benefit is the amount of money that is paid out when a valid life insurance claim is filed.

They both reflect the amount of money that the insurance company will pay out in the case of a valid claim.

How Much Is A 1 Million Life Insurance Policy Who Needs It Life Insurance Policy Permanent Life Insurance Life Insurance Cost

Group Life Insurance Life Insurance Glossary Definition Sproutt

:max_bytes(150000):strip_icc()/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

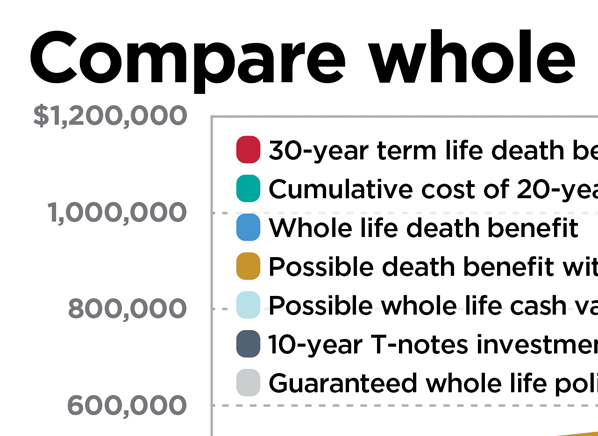

Is Whole Life Insurance Right For You

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

Pin On Insurance Marketing Humor Estate Planning Chronic Critical Illness Annuities Tax Savvy Make Money

Pin On Plan Future Ask For Life Insurance

You Have Heard About Life Insurance And You Know It S Important But What Does It Really Mean Let S Find Out In Simplifying Life Life Insurance Policyholder

What Are Paid Up Additions Pua In Life Insurance

Types Of Individual Life Insurance Life Insurance Policy Term Life Life Insurance Companies

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

Life Insurance Policy Loans Tax Rules And Risks

Check Out This Simple Overview Of Whole Life Insurance Wholelifeinsurance Topwholelife Quo Whole Life Insurance Life Insurance Quotes Life Insurance Policy

How To Read And Understand Your Whole Life Insurance Statement The Insurance Pro Blog

Twitter Universal Life Insurance Life Insurance Quotes Life Insurance Policy

Life Insurance Policy Loans Tax Rules And Risks

Cash Value Life Insurance Life Insurance Glossary Definition Sproutt